Management Policy

Message from the President

Making steady progress with the medium-term management plan to further enhance corporate value

Toho Acetylene was established in 1955 to manufacture and sell dissolved acetylene gas, which is indispensable for core industries. Since then, we have remained committed to “monozukuri” (Japanese term for manufacturing), which is the basis of being a manufacturer. We have supplied the gases society needed, thereby contributing to people’s better lives and enriched living. By constantly responding to the changing times and believing in the future and power of gas, we have remained one step ahead of industry rivals.

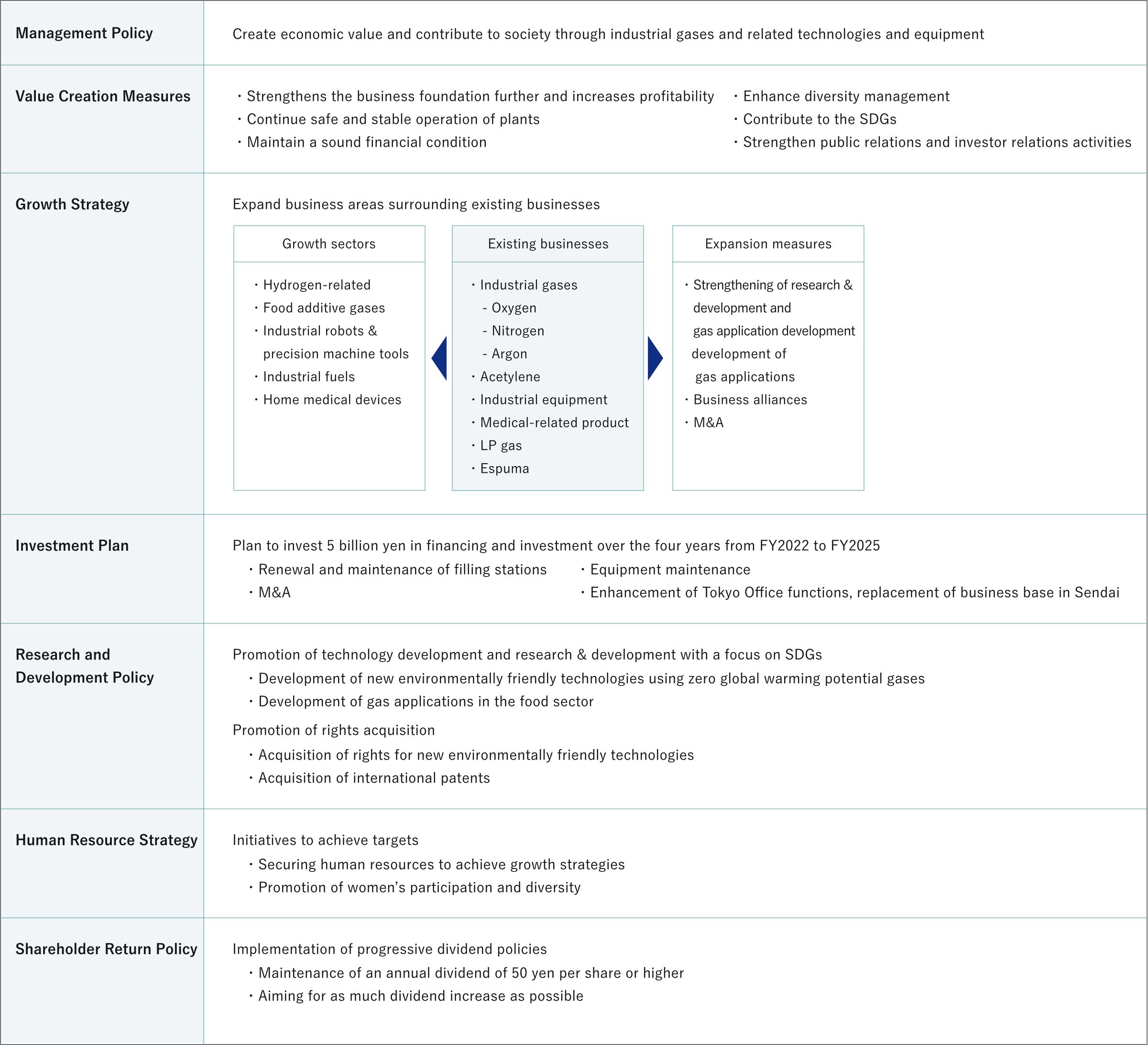

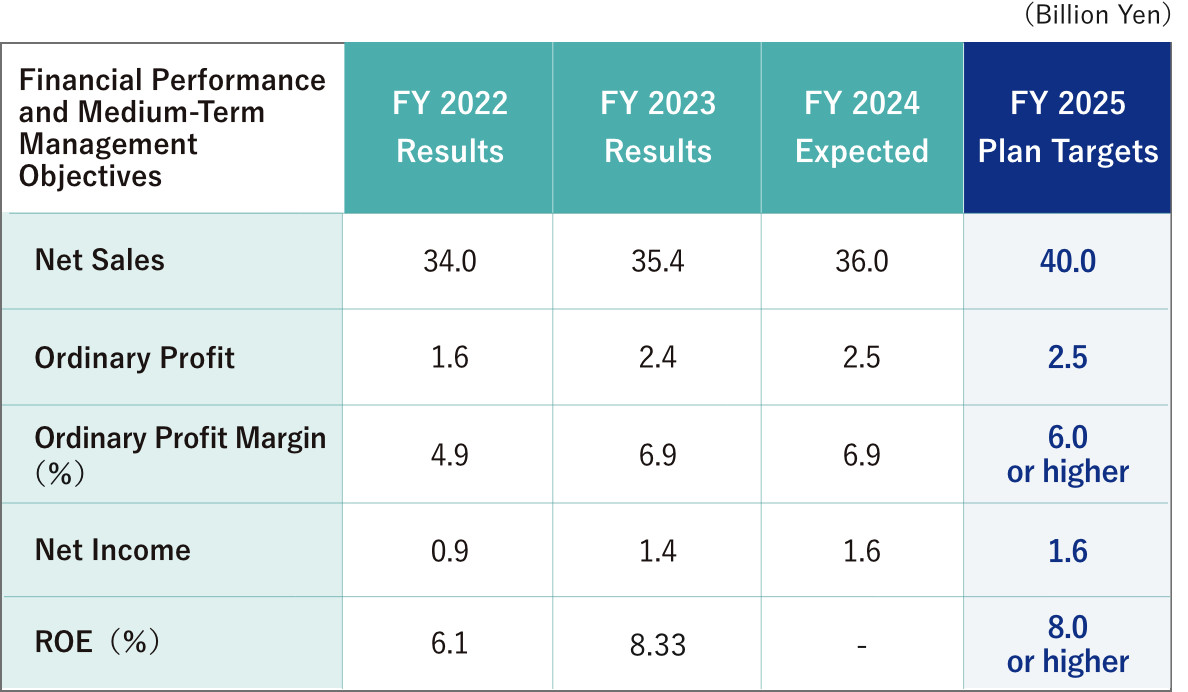

In the face of various societal challenges today, companies are increasingly expected to embrace sustainability and address ESG issues actively. Implementation of our management philosophy of “creating economic value through industrial gases and related technologies and equipment while contributing to society” aligns with our goal of achieving corporate growth by helping to resolve societal issues. Our four-year medium-term management plan launched in FY2022 sets forth specific initiatives to achieve this goal. The external environment, such as the rising prices of raw materials and fuel, continues to make it difficult to steer the company from a management perspective. Nevertheless, consolidated results showed increased revenue and profit for two consecutive years. FY2022 was the first year of the medium-term management plan, and FY2023 was the second year. We also expect continued revenue and profit growth in FY2024, the third year of the plan. Given the harsh business environment, the path to achieving the medium-term management plan is becoming increasingly difficult each year. Even so, we aim to achieve ordinary profit of 2.5 billion yen, net income of 1.6 billion yen, and ROE (return on equity) of 8% or higher by FY2025, the final year of the plan, thus creating a solid foundation for the next medium-term management plan.

As of late, we have achieved specific results through relentless cost reduction, expanding the sales of high-value-added segments of gases used in food applications and promptly reflecting the rise in raw material and fuel costs in our product prices. However, we continue to face a harsh business environment, including rising resource and energy prices stemming from geopolitical risks, soaring logistics costs due to the “2024 problem” (an overtime cap placed on truck drivers in 2024 impacting the logistics industry), and increasing inflation caused by shortages of goods and labor. We thus recognize that further efforts are necessary to ensure that the Group remains on a sustainable growth trajectory toward our vision.

To achieve our medium-term management plan, we must promote dual-strategy management by enhancing the competitiveness of existing businesses and actively investing in growth areas while also steadily implementing business portfolio reforms and strengthening the Group’s corporate value. So far, we have made proactive investments for future growth, such as upgrading and maintaining high-pressure gas filling plants, strengthening the functions of our Tokyo and Osaka branches, and capitalizing on the increasing demand for semiconductors and other products in the Tohoku region. About LP gas, we will positively consider M&A as opportunities arise that may help us maintain or expand our business, as consumer demand is on a downward trend due to the declining population and progress with electrification in the Tohoku region. Regarding LP gas, we will positively consider M&A as opportunities arise that may help us maintain or expand our business, as consumer demand is on a downward trend due to the declining population and progress with electrification in the Tohoku region. Moreover, in industrial applications, demand for fuel conversion from heavy oil and other sources is expected to grow concerning reducing CO2 emissions, and we are committed to addressing this opportunity proactively.

Additionally, we aim to focus on technological development and R&D to achieve the SDGs.

Promoting initiatives from an ESG perspective

We recognize that ESG (Environmental, Social, and Governance) perspectives are essential for a company to sustainably increase its value.

Regarding the environment, we place the highest priority on initiatives related to safety and quality, the foundation of the manufacturing industry. In addition to our ongoing efforts in pollution control and waste reduction, we currently place “response to climate change” as our top priority, under which we are working to systematically mitigate CO2 emissions from our business activities by proactively promoting energy-saving and resource-saving activities.

Concerning society, we value “human resources” as the most significant management resource supporting the sustainable growth of our company. We are committed to creating a work environment where each employee can fully utilize their capabilities and grow while feeling pride and satisfaction in their work. From a long-term perspective, we are also implementing work style reforms that utilize diverse talent to improve work-life balance and productivity. In addition to introducing various systems, such as shortened working hours and remote work, in September 2024, we introduced a Parental Leave Workplace Support Allowance System and an Hourly Annual Paid Leave System to create a comfortable working environment.

In terms of governance, to further separate the supervisory and execution functions by introducing of an executive officer system and to enhance the effectiveness and diversity of the board of directors, we have structured our board with seven directors, including one female director, of whom four are outside directors. Additionally, our Audit & Supervisory board consists entirely of four outside auditors, with two serving as full-time auditors, thereby strengthening the supervision of directorial duties. Regarding internal control, we focus on thoroughly implementing and strengthening the system, and we are confident that this will contribute to further improvement of corporate value.

Looking ahead to future growth and moving forward with our stakeholders

For our Group to achieve sustainable growth, it is crucial to look towards the future and move forward with all our stakeholders, including shareholders and investors. Among these, we place great importance on returning profits to our shareholders. Therefore, we are committed to a progressive dividend policy, with a focus on maintaining stable dividends. We continue to make growth investments with an eye to the future, so please look forward to the fruits of these efforts.

While we anticipate that the business environment surrounding our company will remain challenging, we view the need to address various potential risks as an opportunity to enhance corporate value and expand our revenue. By driving portfolio reforms and achieving growth, we aim to further strengthen the trust of our stakeholders. Our Group aims to be a “shining company originating from Tohoku” that contributes to society’s sustainability while growing sustainably.

We hope that all of our stakeholders look forward to the future of the Toho Acetylene Group and support us as we continue to tackle challenges together.

Medium-Term Management Plan ( FY2022 – FY2025 )